There are a lot of good and even great ideas, being proposed or planned about how to “M.A.W.A.” (“Make America Wealthy Again”) and potentially even “Wealthier Than Ever Before”!

And do it in comparatively “Lightning-Fast” & “Light-Year Fast” “WARP-SPEED”, with the existing proven tech of TETHER HADRON White-Label Platform ,compared to the start from scratch mode. “Who Knew”? ME…that’s who!

In this fast-paced and chaotic world… especially now… “Timing is Everything”. So how can we realistically and feasibly get the methods and mechanisms in place and done “Fast & Furious”,and with a reasonable doable price-tag A.S.A.P.,using existing proven technologies and resources,is the set of keys we need now. To unlock our USA proven Treasures troves & caches’ we need savvy successive action…”Fast & Furious”…Now!

That is how the new Trump admin Is hitting the obstacles ,objections and oppositions now, in a “SPEED-KILLS” (opposition) & “Thrills”(Patriot “TRUMPERS” like ME).They are being overwhelmed and outmaneuvered…so they are in dizzying disarray now!

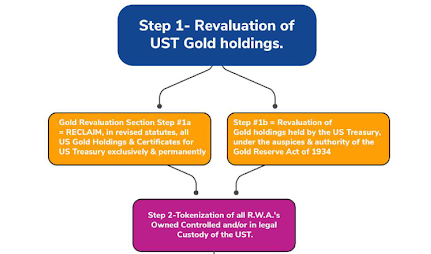

1st & foremost, we need to use the Gold Reserve Act of 1934 which is still enforceable and mostly intact.

The United States Gold Reserve Act of January 30, 1934 required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of the Treasury. It also prohibited the Treasury and financial institutions from redeeming dollar bills for gold, established the Exchange Stabilization Fund under control of the Treasury to control the dollar’s value without the assistance (or approval) of the Federal Reserve, and authorized the president to establish the gold value of the dollar by proclamation.

Immediately following passage of the Act, the President, Franklin D. Roosevelt, changed the statutory price of gold from $20.67 per troy ounce to $35. This price change incentivized gold miners globally to expand production and foreigners to export their gold to the United States, while simultaneously devaluing the U.S. dollar by increasing inflation. The increase in gold reserves due to the price change resulted in a large accumulation of gold in the Federal Reserve and U.S. Treasury, much of which was stored in the United States Bullion Depository at Fort Knox and other locations. The increase in gold reserves increased the money supply, lowering real interest rates which in turn increased investment in durable goods.

Immediately following passage of the Act, the President revalued the price of gold to $35 per troy ounce. This devaluation of the dollar drastically increased the growth rate of the Gross National Product (GNP) from 1933 to 1941. Between 1933 and 1937 the GNP in the United States grew at an average rate of over 8 percent. This growth in real output is due primarily to a growth in the money supply M1, which grew at an average rate of 10 percent per year between 1933 and 1937. Traditional beliefs about the recovery from the Great Depression hold that the growth was due to fiscal policy and the United States’ participation in World War II. Friedman and Schwartz claimed that the “rapid rate [of growth of the money stock] in three successive years from June 1933 to June 1936 … was a consequence of the gold inflow produced by the revaluation of gold plus the flight of capital to the United States”. Treasury holdings of gold in the US tripled from 6,358 in 1930 to 8,998 in 1935 (after the Act) then to 19,543 metric tonnes of fine gold by 1940.

The revaluation of gold referenced was an active policy decision made by the Roosevelt administration in order to devalue the dollar. The largest inflow of gold during this period was in direct response to the revaluation of gold. An increase in M1, which is a result of an inflow of gold, would also lower real interest rates, thus stimulating the purchases of durable consumer goods by reducing the opportunity cost of spending. If the Gold Reserve Act had not been enacted, and money supply had followed its historical trend, then real GNP would have been approximately 25 percent lower in 1937 and 50 percent lower in 1942.

A return to the Gold Standard as the foundational R.W.A.’s :

Since we already supposedly have over 8133 Metric tons of Physical Gold above ground in storage (i.e. Fed Reserve/Treasury Audit incoming) is the Big start to our “Digital Assets Stack” creation. At today’s Mark-to-Market Spot prices in troy ounces it will amount to a substantial asset stack of over $800 Billion USD. And by the time it gets completely converted TO MARK-TO-MARKET RATES it could be close to a TRILLION USD OR MORE at that date’s Spot Price. Before any other RW-Assets are Tokenized and added.

I started researching into overall Blockchain tech not just cryptocurrency on it, and the very large markets on it for Stablecoins and Tokenization of R.W.A.s (i.e. see our White-Paper & website pages herein, for much more ,and/or research it for yourselves with discretion), and realized both Tokenization of R.W.A.s and Stablecoins Markets are so much Bigger and Better,they dwarf the combined crypto total markets valuations many times over, and are much less vulnerable to HACKS and THEFTS,etc. & susceptibility to frequent price volatility,and are not frail “FIAT-Fraud” based. “Stable (Coins and Wealth) is… as Stable Does (perform)”.

I then went on Jan 30-31 2025 to the Plan ₿ Forum El Salvador (https://planb.sv/) is the premier Bitcoin conference in Central America bringing together world leaders, technologists, and entrepreneurs to discuss nation-state Bitcoin adoption, economics, financial freedom, and freedom of speech.

Attended all the lectures by the Forum sponsors(Tether- Stablecoin) Exec staff & Associates,and then pursued some of them to where they were holding some opportunities for Q & A, around the grounds. Until I had my burning questions answered about my main objective there: Their new (Nov 19 2024 release) Tether-HADRON White-Label platform for Tokenization & Stablecoins.

Description follows:

Disclaimer: I am Not associated with Tether nor officially representing them in any capacity. I am just Enthused ,Enamored & Enchanted ,with their “1-stop-shop” super solution: Hadron!

The only “all-in-one solution”, that is Ready & willing to “ROCK the BLOCKCHAIN’s Future-World” now,to allow the USA to “M.A.W.A@ Warp Speed” with our unmatched and invincible array of R.W.A’s.

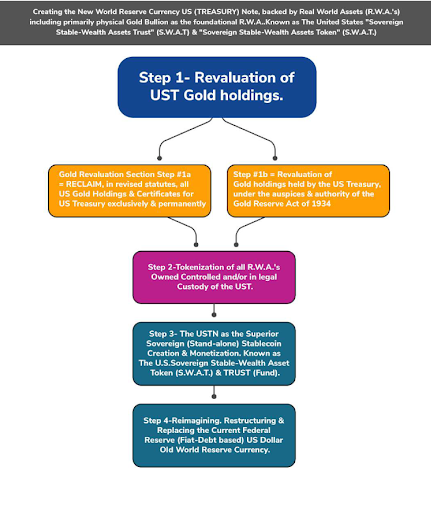

Creating the New World Reserve Currency US (TREASURY) Note, backed by Real World Assets (R.W.A.’s) including primarily physical Gold Bullion, & “Sovereign Stable-Wealth Assets Trust” (S.W.A.T.)™ & “Sovereign Stable-Wealth Assets Token” (S.W.A.T.)™

February 11, 2025

Real world asset (RWA) tokenization is the process of converting real-world assets like dollars, financial securities, real estate, or commodities into digital tokens on a blockchain, enabling cheaper, faster, and more accessible assets.

With growing demand for financial efficiency, market accessibility, and alternative investments, tokenized RWAs are expected to play an increasingly critical role in global financial markets. The ability to combine physical asset ownership with the speed and efficiency of blockchain technology is reshaping legacy financial systems.

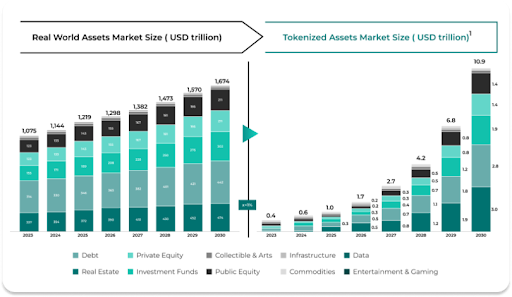

According to Roland Berger, the value of tokenized assets is projected to exceed $10.9 trillion by 2030, with real estate, debt, and investment funds leading as the top three tokenized asset categories.

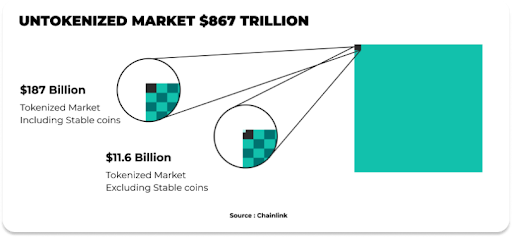

The global value of tokenized real-world assets stands at $867 trillion. As of November 2024, only 0.001346% of this value exists on-chain, highlighting the enormous potential for growth in asset tokenization.

Tokenized RWAs are poised to play a significant role in shaping the next generation of capital markets, helping to bridge the gap between traditional finance and digital assets.

A major benefit of RWA tokenization lies in the ability to break down barriers in asset ownership. Historically, many of these assets were available only to institutional investors or individuals with significant wealth. Fractional ownership changes this by dividing valuable assets into smaller, tradable units, making them accessible to a wider audience while preserving their underlying value.

Tokenizing RWAs provides solutions to several longstanding challenges in asset management and investment:

Tokenization enables near-instant transactions via the blockchain, while enabling markets to operate 24 hours per day, seven days per week, all year round.

Smart contracts automate processes such as compliance checks, dividend distribution, and settlement, reducing reliance on intermediaries and lowering costs.

Tokenization ensures that every transaction is recorded on an immutable ledger, reducing the risk of fraud and providing clear ownership records.

Assets like real estate or fine art, which traditionally take time to buy or sell, become more liquid when tokenized. Tokens can be traded in smaller increments, opening markets to more participants.

Tokenized RWAs offer use cases across multiple markets and asset classes:

Dollar-backed stablecoins provide a stable, liquid, and programmable asset for payments and remittances. They facilitate cross-border transactions, enhance liquidity in tokenized markets, and improve treasury management for institutions.

Tokenization enables broader investor participation in private credit markets by fractionalizing loan portfolios and making them tradable. This could increase access to capital for businesses while providing investors with a new source of yield.

Tokenized treasuries offer near-instant settlement and 24/7 trading, making them more accessible to a global investor base. This enhances the potential liquidity in traditionally rigid fixed-income markets.

Tokenization allows investors to gain exposure to international fixed-income assets with reduced transaction costs and streamlined settlement processes. It could also help issuers tap into a wider, more diverse investor base.

Tokenization has introduced precious metals like gold and agricultural products into the hands of retail investors. Gold-backed tokens like Tether Gold allow smaller investments in a historically stable asset.

Property tokenization enables fractional investment, providing access to high-value properties. By removing intermediaries and automating transactions, tokenized real estate improves market efficiency and lowers costs.

Tokenization of these securities also enhances liquidity and simplifies settlement, enabling greater market participation.

If that’s not enough yet here is what ELON MUSK’s GROK 3 A.I. engine has to say about combining the USA R.W.A.s potential with HADRON Tech:

Determining the totality of Real World Assets (RWAs) in the United States that can be tokenized using Tether’s Hadron white-label tokenization platform involves identifying the types of assets Hadron supports and applying that capability to the vast array of tangible and intangible assets within the U.S. economy. Hadron, launched by Tether in November 2024, is designed to tokenize a wide range of assets, including stocks, bonds, stablecoins, loyalty points, real estate, commodities, funds, and more complex instruments like basket-collateralized products.

Since it’s a white-label platform, it offers customizable, scalable solutions for businesses, institutions, and potentially governments to digitize assets on blockchain networks However, no comprehensive, up-to-date figure exists that precisely quantifies all U.S. RWAs eligible for tokenization, so we’ll approach this by exploring the scope of applicable asset classes and their estimated values based on available economic data as of February 20, 2025.

Hadron’s capabilities are broad. It supports tokenization of financial instruments (e.g., equities, bonds, funds), physical assets (e.g., real estate, art, commodities), and intangible assets (e.g., loyalty points, intellectual property). It operates as a non-custodial platform with compliance tools like KYC and AML, and it integrates with multiple blockchains, including Bitcoin Layer 2 solutions like Liquid by Blockstream. This flexibility suggests that virtually any asset with ownership rights that can be legally digitized and traded could be tokenized via Hadron, assuming regulatory approval and technical feasibility.

Let’s break down the major categories of U.S. RWAs potentially tokenizable with Hadron:

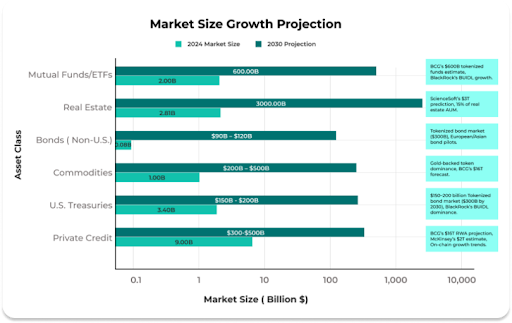

Adding these categories together—real estate ($70 trillion), equities ($50 trillion), bonds ($50 trillion), funds ($30 trillion), cash equivalents ($21 trillion), commodities (trillions more), and smaller classes like IP and loyalty points — the total value of U.S. RWAs potentially tokenizable exceeds $200 trillion. This aligns with broader projections, like Boston Consulting Group’s estimate of a $16 trillion global tokenized illiquid asset market by 2030, of which the U.S. would form a significant chunk.

However, not all assets are immediately tokenizable. Legal frameworks (e.g., securities laws, property rights), regulatory approval, and market readiness impose limits. Hadron’s compliance tools address some of these, but tokenizing the $34 trillion U.S. national debt or every private homes would require unprecedented coordination. Practically, the initial focus might be on liquid or semi-liquid assets like stocks, bonds, and real estate, with commodities and intangibles following as adoption grows.

In summary, the totality of U.S. RWAs that could be tokenized with Hadron spans nearly all economic value—potentially over $200 trillion—covering physical, financial, and intangible assets. The platform’s white-label nature means its actual deployment depends on adopters (e.g., banks, corporations, or states) and regulatory green lights. While the theoretical scope is vast, real-world implementation will likely start with high-value, blockchain-friendly sectors, scaling as trust and infrastructure evolve.

And if TETHER-HADRON and ELON MUSK GROK 3 A.I.,and ME aren’t enough, here is the Legendary Investment and intelligence advisor Jim Rikards(i.e. Google him if you’re not up to speed on “the best of the best” like him) and Robert Kiyosaki (Get a clue…Google who) both say in their most recent advice communiques:

Dear Reader,

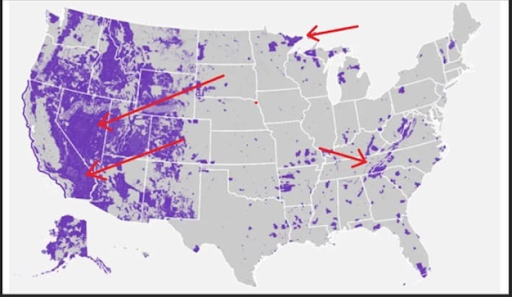

Take a look at this map…

https://en.wikipedia.org/wiki/Fiat_money As with all Fiat Currencies in history, eventually going to a Zero Value… it is just a matter of time to reach its own ‘Destiny of Doom’.

End Of The Road: How Money Became Worthless | Finance Documentary https://www.youtube.com/watch?v=JelncndDsGE&t=1167s

30 North Gould St. / Suite R /Sheridan, Wyoming 82801/USA

Copyright © 2025 revelation2revolution