GOLDMAN”s Mission -(The Disruptor’s Truths Intervention Therapy)

Purpose :

Creating the New World Reserve Currency US (TREASURY) Note, backed by Real World Assets (R.W.A.’s) including primarily physical Gold Bullion, & “Sovereign Stable-Wealth Assets Trust” (S.W.A.T.)™ & “Sovereign Stable-Wealth Assets Token” (S.W.A.T.)™

M.A.W.A./R2R Essentials for“MissionImpossible”accomplisment:

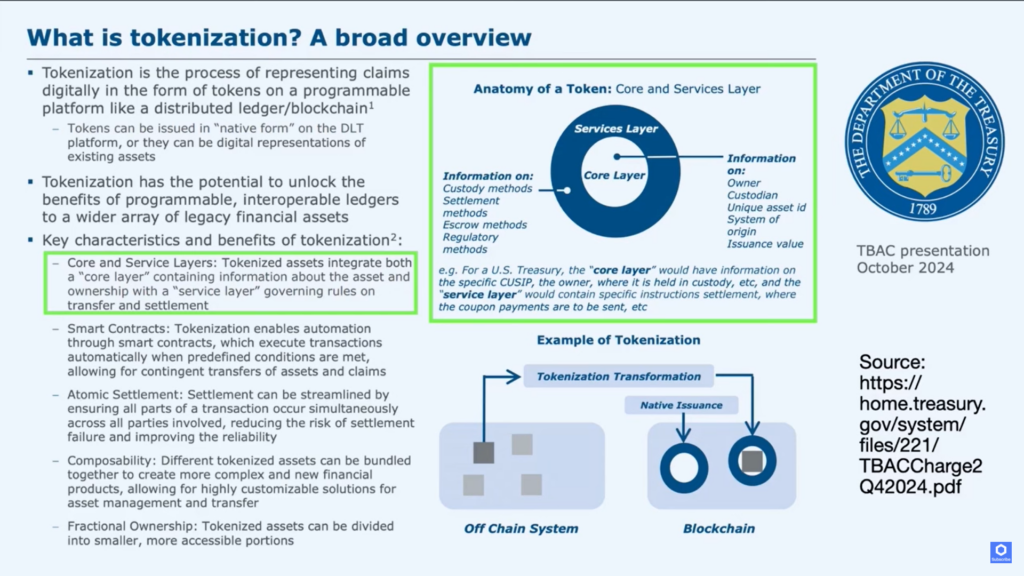

#1-Tokenization of RWA’s

“We have the technology to tokenize today. If you have a tokenized security and identity, the moment you buy or sell an instrument on a general ledger, that is all created together. You want to talk about issues around money laundering. This eliminates all corruption by having a tokenized system.” Larry Fink

https://hadron.tether.to/en/blog/crypto-tokens-vs-rwa-tokens-understanding-the-key-differences

Crypto Tokens vs. RWA Tokens: Understanding the Key Differences

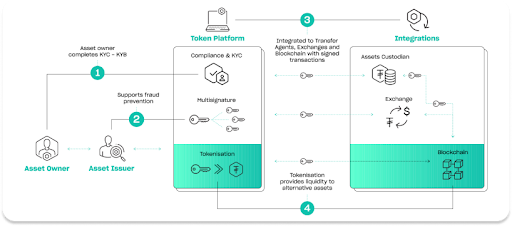

Blockchain technology is revolutionizing finance in two major ways: through cryptocurrency tokens and real-world asset tokenization. Crypto tokens function as a form of money that is purely digital, while RWA tokens represent and are backed by existing physical assets. While both use blockchain technology, they serve different purposes, follow different rules, and have different appeals. Knowing the key distinctions between these two asset types is essential to understanding how digital assets are shaping the future of capital markets.

Defining Crypto Tokens and RWA Tokens

The term ‘cryptocurrency token’ generally refers to digital tokens created on blockchain platforms like Ethereum, Solana, or Avalanche that are not directly tied to any underlying physical asset. Therefore, these tokens tend to be volatile, and their value is predominantly determined by the following factors:

– Market demand

– Utility

– Scarcity

In contrast, real-world asset (RWA) tokenization involves creating blockchain-based tokens that represent ownership or rights to tangible assets. RWA tokens are tethered to the valuation of the underlying asset they represent. Tokenization leverages the speed, reliability, and efficiency of blockchain technology to provide a new financial infrastructure for the ownership of physical assets. Examples include stablecoins, real estate, commodities, or financial instruments.

Purpose and Use Cases

Crypto tokens function as a form of decentralized currency that provide value or utility on blockchain platforms. Many follow ERC-20, a widely used standard for creating fungible tokens on Ethereum, powering DeFi applications like lending, staking, and liquidity provision. They also enable decentralized governance through DAOs (Decentralized Autonomous Organizations), which are community-driven entities where decisions are made collectively through token-based voting.

The most common use case for RWA tokenization to date is stablecoins: digital tokens pegged to national currencies, such as the U.S. dollar. Users can redeem their USD stablecoin for US Dollars at any time as long as they meet the minimum redemption amounts. Stablecoins are emerging as a leading digital currency due to their transactional speed and efficiency, especially with cross-border payments. Tether (USDT) is the largest stablecoin provider, with over $143 billion USDT in circulation as of March 2025, allowing users to hold and transfer value globally without exposure to volatility.

Other RWA use cases include Tether Gold (XAU₮), which allows investors to own fractional shares of physical gold stored in Swiss vaults, with 24/7 tradability. While tokenized gold was one of the earliest tokenized RWA use cases, any physical commodity can be tokenized, such as precious metals and agricultural products.

Oil and energy assets benefit from tokenization by reducing transaction costs and enabling fractional ownership. Tokenized mineral rights let landowners monetize underground resources without giving up land ownership, while carbon credits support sustainable energy practices. In agriculture, tokenization of crops like soybeans, wheat, and coffee gives farmers direct access to capital while improving supply chain efficiency. Another use case is a tokenized real estate project, which can divide ownership into digital shares, allowing fractional investment. DeFi integration enables collateralized loans and asset-backed stablecoins, using tokenized assets such as gold and oil as alternative collateral.

Underlying Technology

While both crypto and RWA tokens leverage blockchain technology, their implementations differ significantly. Crypto tokens exist as assets on their respective blockchain ecosystems and operate on decentralized networks. These digital assets gain value based on factors such as scarcity, utility, and network adoption.

RWA tokenization relies on blockchain but is specifically designed to digitally represent real-world assets. This process involves using smart contracts, which are self-executing agreements with terms written in code, to automate ownership management and transactions, ensuring that asset transfers remain transparent, efficient, and secure. These tokens adhere to widely accepted blockchain standards, such as ERC-20 for fungible assets, enabling interoperability across multiple networks.

Oracles, which are tools that connect blockchains to external data sources, play a crucial role in integrating off-chain data—such as real estate valuations, gold reserves, or financial instruments—into blockchain environments, ensuring that tokenized assets accurately reflect their real-world counterparts.

To enhance security and efficiency, Hadron by Tether integrates with established blockchain infrastructures that prioritize regulatory compliance, security, and customization. These collaborations offer a proven and reliable framework for secure asset tokenization while maintaining the fundamental principles of decentralization. Multi-chain architectures further enable issuers to tailor their tokenized assets to meet specific regulatory and market requirements, ensuring flexibility across different jurisdictions.

Beyond improving efficiency, RWA tokenization is paving the way for new capital markets, particularly in commodities and financial instruments. By digitizing traditionally illiquid assets, institutions, governments, and businesses can increase liquidity, unlock capital for large-scale projects, and attract a broader base of global investors. This approach fosters economic development by transforming physical assets into easily tradable, accessible financial instruments on blockchain networks.

The Next Generation of Capital Markets

Blockchain technology is disrupting global finance by enabling borderless transactions, decentralized applications, and new forms of value exchange.

RWA tokens are at the forefront of the next generation of capital markets, transforming how assets are owned, traded, and valued. By bridging traditional finance with blockchain technology, they unlock new levels of liquidity, transparency, and accessibility, enabling fractional ownership of high-value assets and reducing barriers to investment. As adoption grows, RWA tokens have the potential to reshape global markets, making them more efficient, inclusive, and resilient in the digital economy.

A Tokenized Future

Hadron by Tether gives banks, financial institutions, and businesses the tools to manage digital assets securely, stay compliant, and improve efficiency. Tokenization increases liquidity and unlocks new market opportunities, giving businesses a competitive edge. As blockchain continues to reshape finance, we help our partners and clients stay ahead—leading the way rather than catching up.

https://hadron.tether.to/en/blog/what-is-the-growth-potential-for-real-world-asset-tokenization

What is the Growth Potential for Real-World Asset Tokenization?

February 11, 2025

Real world asset (RWA) tokenization is the process of converting real-world assets like dollars, financial securities, real estate, or commodities into digital tokens on a blockchain, enabling cheaper, faster, and more accessible assets.

With growing demand for financial efficiency, market accessibility, and alternative investments, tokenized RWAs are expected to play an increasingly critical role in global financial markets. The ability to combine physical asset ownership with the speed and efficiency of blockchain technology is reshaping legacy financial systems.

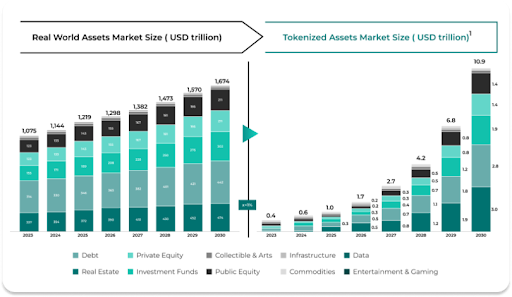

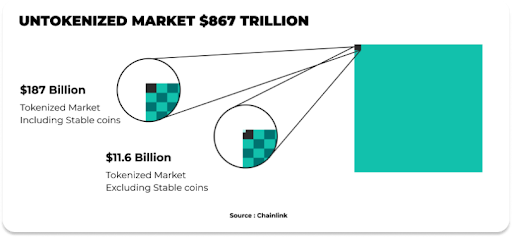

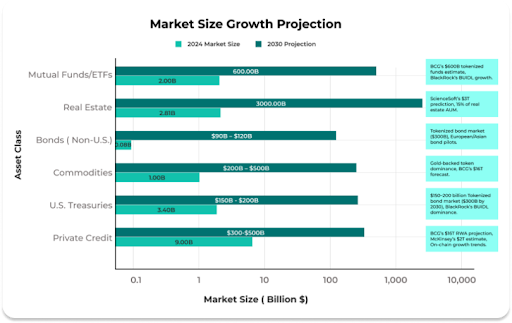

According to Roland Berger, the value of tokenized assets is projected to exceed $10.9 trillion by 2030, with real estate, debt, and investment funds leading as the top three tokenized asset categories.

The global value of tokenized real-world assets stands at $867 trillion. As of November 2024, only 0.001346% of this value exists on-chain, highlighting the enormous potential for growth in asset tokenization.

Tokenized RWAs are poised to play a significant role in shaping the next generation of capital markets, helping to bridge the gap between traditional finance and digital assets.

Benefits of RWA

A major benefit of RWA tokenization lies in the ability to break down barriers in asset ownership. Historically, many of these assets were available only to institutional investors or individuals with significant wealth. Fractional ownership changes this by dividing valuable assets into smaller, tradable units, making them accessible to a wider audience while preserving their underlying value.

Why Tokenize Real-World Assets?

Tokenizing RWAs provides solutions to several longstanding challenges in asset management and investment:

1. Fast 24/7 Transactions

Tokenization enables near-instant transactions via the blockchain, while enabling markets to operate 24 hours per day, seven days per week, all year round.

2. Operational Efficiency

Smart contracts automate processes such as compliance checks, dividend distribution, and settlement, reducing reliance on intermediaries and lowering costs.

3. Transparency and Security

Tokenization ensures that every transaction is recorded on an immutable ledger, reducing the risk of fraud and providing clear ownership records.

4. Greater Accessibility

Assets like real estate or fine art, which traditionally take time to buy or sell, become more liquid when tokenized. Tokens can be traded in smaller increments, opening markets to more participants.

Use Cases of RWAs

Tokenized RWAs offer use cases across multiple markets and asset classes:

Stablecoins

Dollar-backed stablecoins provide a stable, liquid, and programmable asset for payments and remittances. They facilitate cross-border transactions, enhance liquidity in tokenized markets, and improve treasury management for institutions.

Private Credit

Tokenization enables broader investor participation in private credit markets by fractionalizing loan portfolios and making them tradable. This could increase access to capital for businesses while providing investors with a new source of yield.

US Treasuries

Tokenized treasuries offer near-instant settlement and 24/7 trading, making them more accessible to a global investor base. This enhances the potential liquidity in traditionally rigid fixed-income markets.

Non-US Bonds

Tokenization allows investors to gain exposure to international fixed-income assets with reduced transaction costs and streamlined settlement processes. It could also help issuers tap into a wider, more diverse investor base.

Commodities

Tokenization has introduced precious metals like gold and agricultural products into the hands of retail investors. Gold-backed tokens like Tether Gold allow smaller investments in a historically stable asset.

Real Estate

Property tokenization enables fractional investment, providing access to high-value properties. By removing intermediaries and automating transactions, tokenized real estate improves market efficiency and lowers costs.

Mutual Funds/ETFs

Tokenization of these securities also enhances liquidity and simplifies settlement, enabling greater market participation.

If that’s not enough yet here is what ELON MUSK’s GROK 3 A.I. engine has to say about combining the USA R.W.A.s potential with HADRON Tech:

What are the totality of Real World Assets of The United States of America that can be tokenized with the Hadron white-label tokenization platform of Tether?

Determining the totality of Real World Assets (RWAs) in the United States that can be tokenized using Tether’s Hadron white-label tokenization platform involves identifying the types of assets Hadron supports and applying that capability to the vast array of tangible and intangible assets within the U.S. economy. Hadron, launched by Tether in November 2024, is designed to tokenize a wide range of assets, including stocks, bonds, stablecoins, loyalty points, real estate, commodities, funds, and more complex instruments like basket-collateralized products.

Since it’s a white-label platform, it offers customizable, scalable solutions for businesses, institutions, and potentially governments to digitize assets on blockchain networks However, no comprehensive, up-to-date figure exists that precisely quantifies all U.S. RWAs eligible for tokenization, so we’ll approach this by exploring the scope of applicable asset classes and their estimated values based on available economic data as of February 20, 2025.

Hadron’s capabilities are broad. It supports tokenization of financial instruments (e.g., equities, bonds, funds), physical assets (e.g., real estate, art, commodities), and intangible assets (e.g., loyalty points, intellectual property). It operates as a non-custodial platform with compliance tools like KYC and AML, and it integrates with multiple blockchains, including Bitcoin Layer 2 solutions like Liquid by Blockstream. This flexibility suggests that virtually any asset with ownership rights that can be legally digitized and traded could be tokenized via Hadron, assuming regulatory approval and technical feasibility.

Let’s break down the major categories of U.S. RWAs potentially tokenizable with Hadron:

- Real Estate: The U.S. real estate market is one of the largest asset classes. As of recent estimates, the total value of residential real estate is around $50 trillion, while commercial real estate (offices, retail, industrial) adds roughly $20 trillion. Tokenizing real estate allows fractional ownership, potentially unlocking liquidity for properties ranging from homes to skyscrapers.

- Equities (Stocks): The U.S. stock market, including NYSE and NASDAQ, has a market capitalization exceeding $50 trillion as of early 2025. Publicly traded stocks, and even private equity (valued at several trillion dollars), could be digitized into tokens representing shares or fractional stakes.

- Bonds and Fixed Income: The U.S. bond market, including Treasuries, municipal bonds, and corporate debt, is valued at over $50 trillion. Hadron’s support for tokenized bonds could enable fractional trading of government securities (e.g., the $34 trillion national debt) or corporate issuances.

- Commodities: The U.S. is a major producer of commodities like oil, natural gas, gold, and agricultural goods. The commodity market’s total value fluctuates, but energy reserves alone (e.g., oil and gas) are worth trillions, with gold holdings and agricultural output adding further billions. Hadron’s ability to create commodity-backed tokens aligns with Tether’s recent ventures, like its boron-backed token proposal.

- Funds (Mutual Funds, ETFs, Hedge Funds): The U.S. investment fund industry manages over $30 trillion in assets. Tokenizing these funds could simplify access and trading, especially for retail investors.

- Cash and Cash Equivalents: Represented by stablecoins or tokenized fiat, the U.S. money supply (M2) is around $21 trillion. Hadron’s existing stablecoin expertise (e.g., USDT, with a $125 billion market cap) suggests it could tokenize dollar-backed assets or create new stablecoin variants.

- Intellectual Property and Art: The value of IP (patents, trademarks, copyrights) and fine art is harder to pin down but is estimated in the hundreds of billions. For example, the U.S. art market alone exceeds $20 billion annually, while IP underpins trillion-dollar industries like tech and entertainment.

- Loyalty Points and Other Intangibles: U.S. companies manage loyalty programs valued at over $100 billion in unredeemed points. Hadron’s inclusion of loyalty points as tokenizable assets could digitize these into tradable tokens.

- Infrastructure and Public Assets: Government-owned assets like roads, bridges, and utilities could theoretically be tokenized for alternative financing. The U.S. infrastructure stock is valued at over $10 trillion, though legal and political hurdles might limit this.

Adding these categories together—real estate ($70 trillion), equities ($50 trillion), bonds ($50 trillion), funds ($30 trillion), cash equivalents ($21 trillion), commodities (trillions more), and smaller classes like IP and loyalty points — the total value of U.S. RWAs potentially tokenizable exceeds $200 trillion. This aligns with broader projections, like Boston Consulting Group’s estimate of a $16 trillion global tokenized illiquid asset market by 2030, of which the U.S. would form a significant chunk.

However, not all assets are immediately tokenizable. Legal frameworks (e.g., securities laws, property rights), regulatory approval, and market readiness impose limits. Hadron’s compliance tools address some of these, but tokenizing the $34 trillion U.S. national debt or every private homes would require unprecedented coordination. Practically, the initial focus might be on liquid or semi-liquid assets like stocks, bonds, and real estate, with commodities and intangibles following as adoption grows.

In summary, the totality of U.S. RWAs that could be tokenized with Hadron spans nearly all economic value—potentially over $200 trillion—covering physical, financial, and intangible assets. The platform’s white-label nature means its actual deployment depends on adopters (e.g., banks, corporations, or states) and regulatory green lights. While the theoretical scope is vast, real-world implementation will likely start with high-value, blockchain-friendly sectors, scaling as trust and infrastructure evolve.

Blackrock on Tokenization of Securities:

Next step: Blackrock says tokenization of financial assets:

#2-STABLECOINS(SC)

President Trump Participates in a Signing Ceremony for S.1582 GENIUS Act

https://thedefiant.io/news/regulation/treasury-flags-stablecoins-as-catalyst-for-shift-in-us-financial-system

Treasury Flags Stablecoins as ‘Catalyst’ for Shift in US Financial System

A new report from the U.S. Treasury highlights stablecoin market growth and its potential impact on banking.

https://home.treasury.gov/system/files/221/TBACCharge2Q22025.pdf

The U.S. Department of the Treasury this past week released a new report exploring the rapid growth of stablecoins and their potential impact on traditional banking.

Titled “Digital Money,” the April 30 report noted that the stablecoin sector currently boasts a total market capitalization of around $240 billion — a 2% increase in April alone — with projections suggesting it could surge to $2 trillion by 2028.

The report addresses the effects of yield-bearing stablecoins in particular, and how they could impact traditional U.S. financial institutions, from the perspective of Treasury demand and U.S. dollar hegemony. The report also considers the impact of tokenized money market funds (MMFs).

Stablecoins could “catalyse” significant changes in the financial landscape, depending on regulatory outcomes and how the market responds, the report notes.

Impact of stablecoins on US bank deposits

One major area of impact could be bank deposits, especially if yield-bearing stablecoins are allowed to flourish in the U.S., or if stablecoins can offer other features that rival traditional financial products. Increased competition could pressure banks to raise interest rates to retain deposits or seek alternative funding sources, the report explains.

The report looks at that potential impact of both interest-bearing and non-interest-bearing stablecoins on bank deposits. It concludes that in the case that interest-bearing stablecoins are allowed to expand under U.S. regulations, the impact would be the “potential rotation from traditional deposits into stablecoins, which may offer more usability or competitive rates.”

The Treasury report highlights that U.S. regulations are still unclear on this point, noting that “within currently proposed legislation (the GENIUS Act), there are several factors that are still being determined, which influence the pace at which demand may grow.”

Notably, the report does not mention the other stablecoin bill currently before Congress, the STABLE Act, which was proposed by members of the House of Representatives. Both the GENIUS and STABLE acts passed their respective committees in the Senate and House as of last month. Just this week, however, reports surfaced that Senate Majority Leader John Thune had expedited the vote on the GENIUS Act, reportedly looking to get the bill before the Senate by Memorial Day, which falls on May 26.

As the report notes, the current stablecoin legislation before Congress does not include yield-bearing stablecoins — although the two bills differ slightly in their treatment of them. The GENIUS Act — again, the only stablecoin legislation the Treasury report references explicitly — was amended in committee to exclude yield-bearing stablecoins from the definition of “payment stablecoins,” which the bill seeks to legislate.

While stablecoin demand may have a net neutral effect on the U.S. money supply, the Treasury report added, “the attractiveness of USD-pegged stablecoins could drive currently non-USD liquidity holdings into USD.”

The Pioneer & preeminent SCTether Biggest/ Best = “Size Matters”:

Note: Once we reintroduce SOUND-MONEY again with the New USTN R.W.A.’s Backed direct issue currency,the fiat version will fade away (not so)slowly into oblivion …and all fiat money backed so-called “Stablecoins”from all Central Banks will too.

The USTN will be the only SOUND-MONEY intrinsic value STABLE-WEALTH TOKEN and TRUST FUND and Stable- Wealth-Bonds combo.

NOONE Can compete against real R.W.A.Backed Sound-Money with FIAT Versions… Because no equivalency exists ! End of Story!

https://home.treasury.gov/system/files/221/TBACCharge2Q22025.pdf

So all of this is enabled and enhanced exponentially,when we make it a SOUND-MONEY R.W.A.’s Backed STABLE-WEALTH TOKEN & PHYSICAL CURRENCY NOT OBSOLETE CENTRAL BANK ISSUED FIAT! Capiche?

# 3 & 4- SMOOTHE SUAVE TRANSITION FROM FIAT TO SOUND MONEY,IS IT POSSIBLE…ESPECIALLY @WARP SPEED?

There was a time in US Dollar currency issuance and circulation of the 1960’s and into the 1970’s ,when both the United States Dollar (still Gold backed until AUG 1971) and Federal reserve notes (Fed fake 3rd US central bank issued Fiat, Backed by nothing) transactions transition was in process, both circulated nationaly and internationally. What were those years and months dates of dual issuance and acceptance and total amounts of each in circulation ,and the overall results for the USD dominance as the world reserve currency globally?

The period from the 1960s to the early 1970s marked a significant transition in U.S. currency issuance, during which both United States Notes (sometimes referred to as gold-backed or Treasury-issued currency) and Federal Reserve Notes (fiat currency issued by the Federal Reserve) were in circulation. This transition culminated in the end of the Bretton Woods system in August 1971, when the U.S. dollar’s convertibility to gold was suspended, fundamentally altering its role as the world’s reserve currency. Below, I address the specific questions regarding the years and months of dual issuance and acceptance, the total amounts of each type of currency in circulation, and the impact on USD dominance as the global reserve currency.

1. Years and Months of Dual Issuance and Acceptance

Dual Issuance and Acceptance Period:

- Historical Context: United States Notes and Federal Reserve Notes coexisted in circulation throughout much of the 20th century, including the 1960s and early 1970s. United States Notes, authorized under different statutes from Federal Reserve Notes, were issued by the U.S. Treasury and were historically tied to precious metals (gold or silver) under certain conditions, though by the 1960s, their redeemability was limited. Federal Reserve Notes, issued by the Federal Reserve System since 1914, became the dominant form of U.S. currency and were fiat-based, especially after the U.S. moved away from redeemability in precious metals.

- Key Dates:

- Pre-1960s: Both United States Notes and Federal Reserve Notes were legal tender and circulated simultaneously. United States Notes were issued in denominations like $2, $5, and $100, while Federal Reserve Notes covered a broader range of denominations.

- 1963: A significant change occurred when the phrase “PAYABLE TO THE BEARER ON DEMAND” was removed from newly issued Federal Reserve Notes, signaling a shift away from any implied redeemability in gold or silver.

- 1965: The Coinage Act of 1965 eliminated silver from quarters and dimes, reducing the metallic backing for U.S. currency and further aligning it with fiat principles. Some coins, like the Kennedy Half Dollar, retained 40% silver until 1969.

- 1968: Redemption of pre-1963 Federal Reserve Notes for gold or silver officially ended, marking a clear move toward fiat currency.

- January 1971: Issuance of United States Notes ceased, though existing notes remained in circulation and are still valid legal tender today, albeit rarely seen.

- August 15, 1971: President Richard Nixon announced the suspension of the dollar’s convertibility to gold, effectively ending the Bretton Woods system. This marked the complete transition to a fiat-based Federal Reserve Note system, as the U.S. dollar was no longer tied to gold internationally.

- Post-1971: Federal Reserve Notes became the sole form of paper currency issued, while United States Notes continued to circulate in diminishing quantities.

Summary of Dual Issuance Period:

- Dual issuance and acceptance of United States Notes and Federal Reserve Notes occurred throughout the 1960s until January 1971, when United States Notes stopped being issued. Both were accepted as legal tender nationally and internationally during this period, with Federal Reserve Notes increasingly dominant.

- The critical transition point was August 1971, when the gold backing for the dollar (via international convertibility under Bretton Woods) was severed, completing the shift to fiat Federal Reserve Notes.

2. Total Amounts of Each in Circulation

Precise monthly or yearly data on the exact amounts of United States Notes versus Federal Reserve Notes in circulation during the 1960s and early 1970s is challenging to pinpoint due to limited granular records in the provided references and the complexity of historical Treasury reports. However, I can provide an overview based on available information and general trends:

- United States Notes:

- United States Notes were a smaller portion of the total U.S. currency in circulation by the 1960s. They were issued in limited denominations and were gradually phased out.

- According to historical context, United States Notes peaked in circulation during the 19th and early 20th centuries but were significantly reduced by the 1960s. By the time their issuance ended in January 1971, their circulation was minimal compared to Federal Reserve Notes.

- Estimates suggest that United States Notes constituted less than 5% of total U.S. paper currency in circulation by the late 1960s, with the majority being $2 and $5 notes.

- Federal Reserve Notes:

- Federal Reserve Notes dominated U.S. currency circulation by the 1960s, comprising over 95% of paper currency in circulation.

- As of July 2013, the Federal Reserve Bank of New York reported $1.2 trillion in total U.S. currency in worldwide circulation, with the vast majority being Federal Reserve Notes. While this figure is from a later date, it reflects the trend of Federal Reserve Notes overwhelming other forms of currency by the 1970s.

- In the 1960s, the total currency in circulation (including coins) grew steadily. For example, Treasury reports indicate that total currency in circulation was approximately $40 billion in 1960, rising to about $60 billion by 1970, driven primarily by Federal Reserve Notes.

- Approximate Breakdown:

- 1960: Total currency in circulation ~$40 billion, with Federal Reserve Notes likely accounting for ~$38–39 billion and United States Notes ~$1–2 billion.

- 1970: Total currency in circulation ~$60 billion, with Federal Reserve Notes ~$57–59 billion and United States Notes ~$1 billion or less.

- These figures are estimates based on the dominance of Federal Reserve Notes and the declining role of United States Notes, as precise breakdowns are not explicitly detailed in the references.

- International Circulation:

- By the end of the first quarter of 2021, foreign investors held nearly $1 trillion in U.S. cash, roughly half of all U.S. notes in circulation, indicating significant international use of Federal Reserve Notes. This trend was already evident in the 1960s, as the dollar’s role as the world’s reserve currency drove demand for Federal Reserve Notes abroad.

3. Impact on USD Dominance as the World Reserve Currency

The transition from a gold-backed dollar to a fiat-based Federal Reserve Note system had profound implications for the U.S. dollar’s dominance as the world’s reserve currency. The following outlines the key impacts:

- End of Bretton Woods and the Gold Standard (1971):

- The Bretton Woods system, established in 1944, made the U.S. dollar the world’s reserve currency, convertible to gold at $35 per ounce by foreign central banks. By the 1960s, the U.S. faced pressure due to insufficient gold reserves to cover the dollars in circulation internationally, leading to fears of a gold run.

- Nixon’s suspension of gold convertibility in August 1971 (the “Nixon Shock”) ended the gold-backed dollar, transitioning the global monetary system to floating exchange rates by 1973.

- Contrary to expectations that the dollar’s role would diminish post-Bretton Woods, its dominance persisted and even strengthened in subsequent decades due to the U.S.’s economic size, financial market liquidity, and geopolitical influence.

- Continued Dollar Dominance:

- Despite the shift to fiat currency, the dollar remained the world’s primary reserve currency. By 2000, it accounted for 71% of global foreign exchange reserves, though this declined to 58.4% by Q4 2023.

- The dollar’s role was bolstered by its use in international trade (e.g., 74% of trade in Asia and 96% in the Americas was invoiced in dollars from 1999–2019), its dominance in foreign exchange transactions (nearly 90%), and its use in international debt and banking (60% of international banking claims and liabilities).

- The Federal Reserve’s swap lines and repo facilities, introduced during crises like 2008–2009 and 2020, reinforced the dollar’s role by ensuring access to dollar funding globally, enhancing its stability as the dominant currency.

- Challenges and Resilience:

- The move to fiat currency raised concerns about potential de-dollarization, especially as countries like China and Russia sought alternatives post-1971. However, the dollar’s entrenched role, supported by U.S. economic and military power, deep capital markets, and the lack of viable alternatives (e.g., the euro’s political fragmentation, the renminbi’s capital controls), limited these challenges.

- The Triffin Dilemma, which highlighted tensions between domestic and international objectives for a reserve currency, was a factor in the Bretton Woods collapse but did not immediately undermine dollar dominance. Instead, the dollar’s liquidity and convertibility sustained its global use.

- By the 1970s, the dollar’s role in oil pricing (petrodollar system) further entrenched its dominance, as OPEC priced oil in dollars, creating incentives for global dollar holdings.

- Long-Term Trends:

- While the dollar’s share of global reserves has declined from 71% in 2000 to 58% in 2022, it remains far ahead of the euro (20%) and other currencies.

- Emerging efforts at de-dollarization (e.g., China’s Cross-Border Interbank Payment System, BRICS initiatives like mBridge) have gained traction but are limited by the dollar’s liquidity, convertibility, and the U.S.’s institutional stability.

- The dollar’s “exorbitant privilege” allows the U.S. to borrow at low rates and wield financial sanctions effectively, reinforcing its geopolitical leverage despite the fiat transition.

Overall Results for USD Dominance

- The transition from a gold-backed dollar to a fiat-based Federal Reserve Note system in the 1960s and early 1970s did not diminish the dollar’s status as the world’s reserve currency. Instead, the dollar adapted to a fiat system, maintaining dominance due to:

- The U.S.’s large and stable economy (26% of global GDP in the 2020s).

- Liquid and deep financial markets, particularly for U.S. Treasuries ($7.4 trillion held by foreign investors in 2022).

- The dollar’s role in global trade, banking, and commodity pricing (e.g., oil).

- The Federal Reserve’s ability to provide dollar liquidity during crises.

- The end of gold convertibility removed a constraint on U.S. monetary policy, allowing greater flexibility but introducing risks of inflation and currency debasement. Despite these risks, the dollar’s entrenched role and lack of credible alternatives ensured its continued dominance.

- Critical examination of the narrative suggests that while the fiat transition was a bold move, it succeeded because of the U.S.’s unmatched economic and military power, not because fiat currency is inherently superior. The dollar’s resilience reflects trust in U.S. institutions, but ongoing de-dollarization efforts and geopolitical shifts could pose long-term challenges.

Notes on Data Limitations

- Exact figures for United States Notes versus Federal Reserve Notes in circulation during the 1960s–1970s are not fully detailed in the provided references. Estimates are based on historical trends and the dominance of Federal Reserve Notes.

- For precise data, historical Treasury Department reports or Federal Reserve archives (e.g., Annual Reports of the Secretary of the Treasury) would be needed, which are not accessible here.

- If you require more granular data, I can guide you to primary sources like the Treasury’s “Circulation Statement of United States Money” or suggest further research.

Conclusion

The dual issuance and acceptance of United States Notes and Federal Reserve Notes spanned the 1960s until January 1971, with the pivotal shift to a fiat system completed in August 1971. Federal Reserve Notes dominated circulation, with total U.S. currency rising from ~$40 billion in 1960 to ~$60 billion in 1970, of which United States Notes were a small fraction. The transition to fiat currency did not undermine USD dominance; rather, the dollar’s role as the world’s reserve currency was reinforced by U.S. economic power, financial market depth, and global trust in its institutions. However, the fiat system introduced long-term risks that continue to fuel de-dollarization debates today.

THATS ALL FOR NOW FOLKS! 4 PARTS IN SUCCESSION AND THE SUM-WHAT SIMULTANEOUS ACTIONS IN PARTS WHEN APROPOS,FROM “GUFFAW” TO GLORY…A GOLDEN DESTINY…LIKE NEVER EVER BEFORE!

GoldMan 2.0 ,the SuperHero of Sustainability of Mankind…and ergo the enemy of the Deep-State Destroyers of Humanity… guarantees it!

GOLDMAN’s Other fully Patented Granted Invention “Impossible Mission” accomplished ,a Business Process Utility Patent #US10423974 (1)B2 Goldback rebates patent granted SMK.pdf

For The World’s 1st & Only Loyalty/Rewards (L/R’s) arena ($181 Billion Market Globally) Gold-Back Rebates (i.e. “CACHE-BACK”= “TREASURE”/ not “Cash-Back”= TRASH) ,or other fiat L/R (ie. all Cash-back, Points,Airmiles, Coupons,Corporate/Brand Bucks, Crypto- have no intrinsic value,all subject to “Inflation Tax”)…except GOLD!ONLY GOLD Gains Value with Inflation all other L/R are FIAT LOSERS!

** Note: We can do Gold-Back Rebates on any or all R-.W.A.’s where appropriate, for added and/or alternative R.O.I. for investors/buyers of them.

Video explainer:

** I/We wil persist until we succeed with a full Patent Granted as we did with the one above..against all: Odds,

Opinions,Objections,Obstacles to be Overcome …till we were done with the Win-Win-Win Granted.

Now below are a few excerpts from our Patent-Pending application present status:

Note: A Patent-Pending Business-Process Utility Patent, is not searchable on USPTO Public Search engine or Google Patents search engine. So, below are a couple of critical Excerpts that should be understandable (i.e. not too Technically Jargoned) to most basically Intelligent people:

1-a=Patent-Pending Abstract Excerpt section:

ABSTRACT

SYSTEM AND МЕТHOD FOR IMPLEMENTING A REAL-WORLD ASSEТ-ВАСKED SOVEREIGN DIGITAL CURRENCY USING DISTRIBUTED LEDGER TECHNOLOGY

Embodiments of the present disclosure may include a sovereign digital currency system including a blockchain network including a plurality of authorized nodes. Embodiments may also include a real-world asset (RWA)registry configured to maintain digital records of physical assets including gold reserves and government-owned resources. Embodiments may also include generate unique digital identifiers for each registered physical asset. Embodiments may also include track chain of custody information for each registered physical asset. Embodiments may also include a tokenization engine coupled to the RWA registry and configured to create digital tokens backed by the registered physical assets. Embodiments may also include maintain a predefined reserve ratio between issued tokens and registered physical assets. Embodiments may also include execute smart contracts governing the creation and destruction of digital tokens.

PATENT DESCRIPTION

Title: SYSTEM AND METHOD FOR IMPLEMENTING A REAL-WORLD ASSEТBACKED SOVEREIGN DIGITAL CURRENCY USING DISTRIBUTED LEDGER TECHNOLOGY

FIELD OF THE DISCLOSURE

[1] The present invention relates generally to digital currency systems and, more particularly, to systems and methods for implementing a sovereign digital currency backed by real-world assets through distributed ledger technology.

BACKGROUND OF THE RELATED ART

[2] The global financial system has historically relied on fiat currencies issued by central banks and other monetary authorities. Since the abandonment of the gold standard in 1971, most major currencies, including the U.S. dollar, have operated without direct backing by physical assets. This transition to pure fiat currency systems has led to various challenges, including currency volatility, inflation risks, and questions about long-term value stability.

[3] Traditional reserve currencies, particularly the U.S. dollar, have played a crucial role in international trade and finance. The Bretton Woods Agreement of 1944 established the dollar as the global reserve currency, with the U.S. committing to back dollars with gold at a fixed rate of $35 per ounce. However, by the late 1960s, the system became unsustainable as U.S. gold reserves proved insufficient to maintain the fixed exchange rate, leading to the termination of dollar-gold convertibility in 1971.

[4] The evolution of digital technologies, particularly blockchain and distributed ledger systems, has created new possibilities for currency implementation. The emergence of cryptocurrencies, beginning with Bitcoin in 2009, demonstrated the potential for digital assets to function as a medium of exchange. However, the high volatility of these early cryptocurrencies limited their utility as stable stores of value or reliable means of payment.

[5] In response to cryptocurrency volatility, stablecoins emerged as a potential solution. These digital tokens are typically pegged to existing fiat currencies or assets, aiming to maintain a stable value. However, current stablecoin implementations face several limitations. Many rely on traditional fiat currencies for backing, inheriting the underlying risks of those currencies. Others use complex algorithmic mechanisms that have proven vulnerable to market stress, as demonstrated by the collapse of TerraUSD in May 2022.

[6] The concept of asset-backed currencies isn’t new. The Gold Reserve Act of 1934 previously regulated the relationship between physical gold reserves and currency valuation in the United States. The Act required all gold and gold certificates held by the Federal Reserve to be surrendered and vested in the sole title of the United States Department of the Treasury. This historical precedent provides important lessons for modern digital currency implementations.

[7] Current approaches to sovereign digital currencies, including Central Bank Digital Currencies (CBDCs), typically focus on digitizing existing fiat currencies rather than fundamentally redesigning the underlying monetary system. While several countries are exploring or implementing CBDCs, these solutions generally maintain the existing fiat currency model without introducing asset backing or hanced stability mechanisms.

[8] Existing systems for managing national treasuries and reserves typically rely on centralized databases and traditional financial infrastructure. These systems often lack transparency, real-time valuation capabilities, and efficient mechanisms for fractionalizing and

tokenizing physical assets. The absence of modern distributed ledger technology in these systems limits their ability to provide ransparent, efficient, and secure management of national assets.

[9] The use of real-world assets (RWAs) as currency backing presents significant technical challenges. Traditional systems struggle with real-time valuation, fractionalization, and efficient transfer of asset-backed tokens. Furthermore, existing solutions often lack robust mechanisms for maintaining and verifying reserve ratios, managing token supply, and ensuring regulatory compliance.

[10] Previous attempts to create asset-backed digital currencies have faced numerous obstacles, including:

- Insufficient technological infrastructure for managing and tracking physical assets

- Lack of reliable real-time valuation mechanisms

- Inadequate security measures for protecting digital assets

- Limited ability to integrate with existing financial systems

- Challenges in maintaining regulatory compliance

- Difficulty in implementing effective monetary policies

[11] Recent developments in blockchain technology, particularly in permissioned networks and smart contracts, have created new opportunities for implementing sophisticated asset-backed currency systems. However, existing solutions have not fully leveraged these technologies to create a comprehensive sovereign digital currency system backed by real-world assets.

[12] The present invention addresses these limitations by providing a novel system for implementing a sovereign digital currency backed by real-world assets, incorporating advanced distributed ledger technology, smart contracts, and secure asset management capabilities. The invention enables transparent, secure, and efficient management of national assets while providing a stable and reliable digital currency system.

SUMMARY OF THE INVENTION

[13] Embodiments of the present disclosure may include a sovereign digital currency system including a blockchain network including a plurality of authorized nodes. Embodiments may also include a real-world asset (RWA)registry configured to maintain digital records of physical assets including gold reserves and government-owned resources.

[14] Embodiments may also include generate unique digital identifiers for each registered physical asset. Embodiments may also include track chain of custody information for each registered physical asset. Embodiments may also include a tokenization engine coupled to the RWA registry and configured to create digital tokens backed by the registered physical assets.

[15] Embodiments may also include maintain a predefined reserve ratio between issued tokens and registered physical assets. Embodiments may also include execute smart contracts governing the creation and destruction of digital tokens. Embodiments may also include a valuation oracle network configured to receive real-time price data for the registered physical assets from multiple authorized sources.

[16] Embodiments may also include compute aggregate asset valuations using a consensus mechanism. Embodiments may also include automatically trigger revaluation events based on market conditions. Embodiments may also include a treasury management module configured to control minting and burning of the digital tokens. Embodiments may also include monitor reserve ratios in real-time. Embodiments may also include enforce compliance with predefined monetary policies. Embodiments may also include manage the distribution of digital tokens through authorized channels. Embodiments may also include a security layer implementing rolebased access controls and encryption for all system components.

[17] In some embodiments, the blockchain network may include a permissioned distributed ledger implemented using Hyperledger Fabric. In some embodiments, the authorized nodes may be operated by designated government entities. In some embodiments, the RWA registry may include a digital twin generator configured to create virtual representations of the physical assets. Embodiments may also include a validation module configured to verify authenticity and ownership of the physical assets. Embodiments may also include a location tracking system configured to monitor movements of the physical assets. Embodiments may also include an audit trail generator configured to record all asset-related transactions.

[18] In some embodiments, the tokenization engine implements fractional tokenization allowing multiple tokens to represent partial ownership of a single physical asset of the physical assets. In some embodiments, the valuation oracle network may include a primary oracle node operated by a national treasury. Embodiments may also include a plurality of secondary oracle nodes operated by authorized financial institutions. Embodiments may also include a consensus module implementing a Byzantine fault-tolerant protocol. Embodiments may also include an outlier detection system for identifying and excluding anomalous price data.

[19] In some embodiments, the treasury management module may include an automated policy enforcement engine implementing predefined monetary rules. Embodiments may also include a reserve ratio calculator monitoring backing asset coverage. mbodiments may also include a distribution control system managing authorized token issuers. Embodiments may also include a reporting system generating compliance and audit reports.

[20] In some embodiments, the system may include a hardware security module (HSM)network implementing secure key generation and storage. Embodiments may also include encrypted communication channels between system components. Embodiments may also include digital signature verification for all transactions. Embodiments may also include secure backup and recovery procedures.

[21] Embodiments of the present disclosure may also include a method of implementing a sovereign digital currency, the method including registering physical assets owned or controlled by a national treasury in a blockchain-based digital registry by creating digital twin records of the physical assets. Embodiments may also include assigning unique identifiers to each asset of the physical assets.

[22] Embodiments may also include recording asset custody and location information. Embodiments may also include tokenizing the registered physical assets by generating smart contracts defining token parameters. Embodiments may also include establishing reserve requirements for token issuance. Embodiments may also include creating digital tokens backed by the registered physical assets.

[23] Embodiments may also include determining real-time valuations for the registered physical assets by aggregating price data from multiple authorized sources. Embodiments may also include executing consensus algorithms to validate the price data. Embodiments may also include computing composite asset values. Embodiments may also include managing token supply by monitoring reserve ratios between the digital tokens and the registered physical assets. Embodiments may also include automatically adjusting token issuance based on the real-time valuations. Embodiments may also include enforcing compliance with monetary policies. Embodiments may also include distributing the digital tokens through authorized channels while maintaining security controls and audit trails.

[24] In some embodiments, the registering physical assets may include performing physical asset verification through authorized custodians. Embodiments may also include documenting asset characteristics including weight, purity, and condition of the physical assets. Embodiments may also include establishing initial asset valuations through multiple independent assessments. Embodiments may also include creating tamper-evident digital records on the blockchain-based digital registry.

[25] In some embodiments, the tokenizing the registered physical assets may include implementing a hierarchical token structure reflecting different asset classes. Embodiments may also include establishing conversion rates between the different asset classes. Embodiments may also include defining token transfer restrictions based on regulatory requirements. Embodiments may also include implementing automatic token burning mechanisms for token redemptions.

[26] In some embodiments, the determining real-time valuations may include collecting price feeds from authorized market data providers. Embodiments may also include applying weighted averaging based on data source reliability. Embodiments may also include implementing circuit breakers for extreme price movements. Embodiments may also include maintaining historical pricing records for audit purposes.

[27] In some embodiments, the managing token supply may include implementing monetary policy rules through the smart contracts. Embodiments may also include adjusting the token issuance based on economic indicators. Embodiments may also include maintaining minimum reserve ratios between the digital tokens and the registered physical assets. Embodiments may also include coordinating with authorized financial institutions for the distributing the digital tokens.

[28] In some embodiments, the method may include implementing multi-factor authentication for system access. Embodiments may also include maintaining comprehensive audit logs of all operations. Embodiments may also include performing regular system security assessments. Embodiments may also include executing disaster recovery procedures.

[29] Embodiments of the present disclosure may also include a non-transitory computer-readable medium storing instructions that, when executed by one or more processors, cause the one or more processors to perform operations implementing a sovereign digital currency, the operations including maintaining a distributed ledger recording ownership and attributes of physical assets registered by a national treasury.

[30] Embodiments may also include executing smart contracts that generate digital tokens backed by the physical assets. Embodiments may also include enforce predefined reserve ratios between the digital tokens and the physical assets. Embodiments may also include automate token lifecycle management. Embodiments may also include receiving real-time asset pricing data from authorized oracle nodes.

[31] Embodiments may also include computing aggregate asset valuations using consensus mechanisms. Embodiments may also include controlling token supply through automated minting and burning based on monetary policies. Embodiments may also include reserve ratio monitoring. Embodiments may also include compliance enforcement. Embodiments may also include managing token distribution through authorized channels. Embodiments may also include maintaining secure access controls and comprehensive audit trails for all operations.

[32] In some embodiments, the instructions further cause the one or more processors to implement a permissioned blockchain network using Hyperledger Fabric. Embodiments may also include manage node authorization and access controls. Embodiments may also include maintain consensus among authorized nodes. Embodiments may also include execute the smart contracts governing token operations.

[33] In some embodiments, the maintaining the distributed ledger may include implementing data encryption for asset records. Embodiments may also include managing digital signatures for transactions. Embodiments may also include executing consensus protocols for ledger updates. Embodiments may also include maintaining backup copies across authorized nodes of the authorized oracle nodes.

[34] In some embodiments, the executing smart contracts may include implementing token issuance rules. Embodiments may also include enforcing transfer restrictions on the digital tokens. Embodiments may also include managing token lifecycle events. Embodiments may also include maintaining compliance with regulatory requirements.

[35] In some embodiments, the computing aggregate asset valuations may include collecting the real-time asset pricing data from multiple authorized sources. Embodiments may also include applying validation rules to identify anomalous data. Embodiments may also include computing weighted averages based on source reliability. Embodiments may also include maintaining historical valuation records.

[36] In some embodiments, the controlling token supply may include implementing monetary policy rules through the smart contracts. Embodiments may also include monitoring economic indicators. Embodiments may also include adjusting token issuance parameters based on the economic indicators. Embodiments may also include maintaining required reserve ratios between the digital tokens and the physical assets.

[37] In some embodiments, the instructions further cause the one or more processors to implement role-based access control for system operations. Embodiments may also include maintain audit logs of all system operations. Embodiments may also include execute security protocols for data protection. Embodiments may also include perform automated system health monitoring.

BRIEF DESCRIPTION OF THE DRAWINGS

[38] The accompanying drawings illustrate several embodiments of the invention and, together with the description, serve to explain the principles of the invention according to the embodiments. One skilled in the art will recognize that the particular embodiments illustrated in the drawings are merely exemplary, and are not intended to limit the scope of the present invention.

[39] FIG. 1 is a block diagram illustrating a sovereign digital currency system, according to some embodiments of the present disclosure.

[40] FIG. 2 is a block diagram further illustrating the sovereign digital currency system from FIG. 1, according to some embodiments of the present disclosure.

[41] FIG. 3 is a block diagram further illustrating the sovereign digital currency system from FIG. 1, according to some embodiments of the present disclosure.

[42] FIG. 4 is a block diagram further illustrating the sovereign digital currency system from FIG. 1, according to some embodiments of the present disclosure.

[43] FIG. 5 is a block diagram further illustrating the sovereign digital currency system from FIG. 1, according to some embodiments of the present disclosure.

[44] FIG. 6A is a flowchart illustrating a method of implementing a sovereign digital currency, according to some embodiments of the present disclosure.

[45] Figure 6B is a flowchart extending from figure 6A and further illustrating the method of implementing a sovereign digital currency, according to some embodiments of the present disclosure.

[46] Figure 6C is a flowchart extending from figure 6B and further illustrating the method of implementing a sovereign digital currency from figure 6A, according to some embodiments of the present disclosure.

[47] FIG. 7 is a flowchart further illustrating the method of implementing a sovereign digital currency from FIG. 6A, according to some embodiments of the present disclosure.

[48] FIG. 8 is a flowchart further illustrating the method of implementing a sovereign digital currency from FIG. 6A, according to some embodiments of the present disclosure.

[49] FIG. 9 is a flowchart further illustrating the method of implementing a sovereign digital currency from FIG. 6A, according to some embodiments of the present disclosure.

[50] FIG. 10 is a flowchart further illustrating the method of implementing a sovereign digital currency from FIG. 6A, according to some embodiments of the present disclosure.

[51] FIG. 11 is a flowchart further illustrating the method of implementing a sovereign digital currency from FIG. 6A, according to some embodiments of the present disclosure.

[52] FIG. 12 is a block diagram illustrating a non-transitory computer-readable medium storing instructions, according to some embodiments of the present disclosure.

DETAILED DESCRIPTION OF THE INVENTION

[53] Unless otherwise defined, all technical terms used herein related to digital currency systems, blockchain technology, asset tokenization, and treasury management have the same meaning as commonly understood by one of ordinary skill in the relevant arts of distributed ledger technology, digital finance, and monetary systems. It will be further understood that terms such as “smart contracts,” “distributed ledger,” “tokenization,” and other technical terms commonly used in the fields of blockchain technology and digital currency systems should be interpreted as having meanings consistent with their usage in the context of this specification and

the current state of digital currency technology. These terms should not be interpreted in an idealized or overly formal sense unless expressly defined herein. For brevity and clarity, wellknown functions or constructions related to blockchain systems, cryptographic protocols, or digital asset management may not be described in detail.

[54] The terminology used herein describes particular embodiments of the sovereign digital currency system and is not intended to be limiting. As used herein, singular forms such as “a blockchain node,” “an oracle network,” and “the tokenization engine” are intended to include plural forms as well, unless the context clearly indicates otherwise. Similarly, references to “consensus mechanism” or “validation process” should be understood to include multiple instances or variations of such elements, where applicable.

[55] With reference to the use of the words “comprise” or “comprises” or “comprising” in describing the components, processes, or functionalities of the sovereign digital currency system, and in the following claims, unless the context requires otherwise, these words are used on the basis and clear understanding that they are to be interpreted inclusively rather than exclusively. For example, when referring to “comprising a tokenization engine,” the term should be understood to mean including but not limited to the described tokenization capabilities, and may include additional related functionalities or components not explicitly described. Each instance

of these words is to be interpreted inclusively in construing the description and claims, particularly in relation to the modular and scalable nature of the digital currency system described herein.

[56] Furthermore, terms such as “connected,” “coupled,” or “integrated with” as used in describing the interaction between various components of the system (such as between the RWA registry and the tokenization engine) should be interpreted to include both direct connections and indirect connections through one or more intermediary components, unless explicitly stated otherwise. References to “tokenizing,” “validating,” or “computing” should be understood to encompass both synchronous operations and asynchronous or batch processing functionality, unless specifically limited to one or the other in the context.

[57] Referring to FIG. 1, a sovereign digital currency system 102 is illustrated according to various embodiments of the present disclosure. The system 102 provides a comprehensive architecture for implementing a secure, asset-backed digital currency infrastructure through multiple integrated components operating in conjunction with one another.

[58] The system 102 includes a blockchain network 104 serving as the foundational infrastructure. The blockchain network 104 comprises a plurality of authorized nodes 106 distributed across secure government facilities. In preferred embodiments, the blockchain network 104 is implemented using Hyperledger Fabric as a permissioned enterprise blockchain framework, enabling high-throughput consensus protocols and secure inter-node communication channels while maintaining strict access controls.

[59] A real-world asset (RWA) registry 108 functions as the authoritative database for all physical assets backing the digital currency. The RWA registry 108 maintains records of gold reserves 110 stored in secured government vaults and various government-owned resources 120 including, but not limited to, mineral rights, land, and infrastructure. A chain of custody tracking system 112 maintains complete asset lineage through automated verification protocols and realtime inventory management capabilities.

[60] The system 102 further includes a tokenization engine 122 coupled bidirectionally with the RWA registry 228. The tokenization engine 122 performs critical functions including the creation of digital tokens backed by verified physical assets, implementation of fractional

tokenization algorithms, and management of token-to-asset reserve ratios. Smart contracts executed by the tokenization engine 122 govern the entire token lifecycle while maintaining seamless integration with treasury management systems.

[61] A valuation oracle network 114 provides real-time asset valuation services through aggregate asset valuation computation 124 using multi-source data. The network implements Byzantine fault-tolerant consensus mechanisms for processing real-time price feeds from authorized sources. The valuation oracle network 114 includes automated revaluation trigger systems and continuous market condition monitoring and analysis capabilities.

[62] The treasury management module116 maintains operational control through token minting and burning controls 126, employing real-time reserve ratio monitoring and monetary policy enforcement mechanisms. The module oversees compliance management systems and maintains comprehensive distribution channel oversight to ensure proper token circulation.

[63] A security layer 118 implements comprehensive protection through role-based access controls and end-to-end encryption protocols. The security layer 118 maintains continuous audit logging mechanisms, intrusion detection systems, and robust disaster recovery capabilities to ensure system integrity and resilience.

[64] Referring now to FIG. 2, a detailed view of the RWA registry 228 components and their interactions is provided. The RWA registry 228 includes a digital twin generator 230 that creates and maintains virtual representations of physical assets through high-fidelity asset modeling and real-time state synchronization. The generator continuously tracks attributes, monitors environmental conditions, and maintains historical state information for each asset.

[65] A validation module 232 within the RWA registry 228 ensures asset authenticity through multi-factor ownership verification and chain of title validation. The module performs continuous regulatory compliance checking, document authenticity verification, and real-time status monitoring of all registered assets.

[66] The RWA registry 228 further includes a location tracking system 234 providing continuous asset monitoring through GPS-enabled tracking and secure facility integration. The system implements movement authorization protocols and chain of custody validation while maintaining real-time location updates for all tracked assets.

[67] An audit trail generator 236 maintains comprehensive records through immutable transaction logging and time-stamped event recording. The generator tracks all access attempts, manages change tracking, and generates compliance reports as required by regulatory authorities.

[68] Referring to FIG. 3, the detailed architecture of the valuation oracle network 114 is illustrated. A primary oracle node 320, operated by the national treasury, provides authoritative price feeds and market data aggregation. The node performs centralized valuation computation, implements monetary policies, and coordinates overall system operation.

[69] The network includes a plurality of secondary oracle nodes 322 operated by authorized financial institutions. These nodes provide independent price verification and redundant data feeds while maintaining cross-validation capabilities. The secondary nodes supply additional market data input and serve as backup operation capability in case of primary node failure.

[70] A consensus module 324 implements Byzantine fault-tolerance through multi-node agreement protocols and fault detection algorithms. The module manages vote aggregation mechanisms, decision finalization processes, and network synchronization to ensure reliable operation across all nodes.

[71] An outlier detection system 326 ensures data integrity through statistical analysis algorithms and anomaly detection. The system performs continuous price deviation monitoring and data quality validation while generating alerts when anomalous conditions are detected.

[72] Referring to FIG. 4, the treasury management module 116 incorporates multiple sophisticated components for comprehensive financial control and oversight. The automated policy enforcement engine 424 implements predefined monetary rules through a series of smart contracts and automated protocols. These rules govern various aspects of currency operation, including issuance limits, reserve requirements, and monetary policy implementation. The engine continuously monitors system parameters and automatically enforces compliance with established policies without manual intervention.

[73] A key component of the treasury management module 116 is the distribution control system 426, which manages the network of authorized token issuers. This system implements strict protocols for issuer authorization, monitors ongoing compliance, and controls token distribution channels. Through a sophisticated permissioning system, the distribution control system 426 ensures that only properly vetted and authorized entities can participate in token issuance and distribution activities.

[74] The treasury management module 116 further includes a reporting system 428 that generates comprehensive compliance and audit reports. This system maintains detailed records of all system activities, produces regulatory compliance documentation, and generates real-time analytics for treasury oversight. A reserve ratio calculator operates continuously within the module, monitoring backing asset coverage and ensuring maintenance of required reserve levels. The calculator implements sophisticated algorithms to track the relationship between issued tokens and underlying assets in real-time.

[75] Referring to FIG. 5, the sovereign digital currency system 102 incorporates a hardware security module (HSM) network 528 that provides critical security infrastructure. The HSM network 528 implements secure key generation 530 through specialized cryptographic hardware, ensuring the highest level of security for all cryptographic operations. The system includes dedicated secure storage 532 for protecting sensitive cryptographic materials and system parameters.

[76] Digital signature verification 534 is implemented across all transactions within the system, ensuring authenticity and non-repudiation of every operation. The HSM network 528 also maintains secure backup 536 facilities and implements comprehensive recovery procedures 538 to ensure system resilience and continuity. Encrypted communication channels are maintained between all system components, utilizing state-of-the-art cryptographic protocols to ensure data confidentiality and integrity.

[77] Referring to FIGS. 6A through 6C, a detailed method of implementing the sovereign digital currency is illustrated. The process begins at 602 with the registration of physical assets owned or controlled by the national treasury in a blockchain-based digital registry. This registration process encompasses multiple steps, including at 604 the creation of digital twin records for physical assets, at 606 the assignment of unique identifiers to each asset, and at 608 the recording of comprehensive asset custody and location information.

[78] The method continues at 610 with the tokenization of registered physical assets, which involves at 612 the generation of smart contracts defining token parameters, at 614 the establishment of reserve requirements for token issuance, and at 616 the creation of digital tokens backed by the registered physical assets. These tokens are created through secure cryptographic processes and are directly linked to their underlying physical assets.

[79] At 618, the method includes determining real-time valuations for the registered physical assets through a multi-step process. This involves at 620 the aggregation of price data from multiple authorized sources and at 622 the execution of consensus algorithms to validate the price data. At 624, composite asset values are computed using sophisticated valuation models and algorithms.

[80] Token supply management is implemented at 626 through various control mechanisms. This includes at 628 the continuous monitoring of reserve ratios between digital tokens and registered physical assets, and at 630 the automatic adjustment of token issuance based on realtime valuations. The process ensures at 632 the enforcement of compliance with monetary policies and at 634 the controlled distribution of digital tokens through authorized channels while maintaining comprehensive security controls and audit trails.

[81] Referring to FIG. 7, the physical asset registration process includes additional steps 710 through 740, which implement detailed verification and documentation procedures for each registered asset. These steps ensure complete asset validation, proper documentation, and secure recording of all relevant asset information in the system.

[82] Referring to FIG. 8, the asset tokenization process encompasses steps 810 through 840, which detail the specific procedures for converting physical assets into digital tokens. These steps implement sophisticated tokenization protocols, ensuring proper asset representation, maintaining security, and establishing necessary controls for token management.

[83] Referring to FIG. 9, the method of determining real-time valuations for the sovereign digital currency system implements a sophisticated multi-stage process, represented by steps 910 through 940. The process begins with the collection of price feeds from authorized market data providers through secure communication channels. These providers undergo rigorous vetting and must maintain continuous certification to participate in the price feed network. Each provider implements standardized data formats and real-time update protocols to ensure consistency and timeliness of pricing information.

[84] The valuation process applies weighted averaging based on data source reliability metrics, which are continuously updated based on historical accuracy and response time performance. The system maintains dynamic weightings that adjust automatically based on provider performance metrics, ensuring that more reliable sources have greater influence on final valuations. Sophisticated statistical models analyze the historical performance of each data source, calculating reliability scores that influence their weighting in the final price determination.

[85] Circuit breakers for extreme price movements are implemented through a multi-tiered threshold system. Primary thresholds trigger automatic alerts and secondary validation requirements, while more extreme variations may temporarily suspend trading or require manual intervention by authorized personnel. These circuit breakers operate on both individual asset prices and aggregate portfolio values, providing comprehensive protection against market anomalies or manipulation attempts.

[86] The system maintains detailed historical pricing records for audit purposes, incorporating both raw data feeds and processed valuations. These records are stored in tamper-evident data structures within the blockchain network, ensuring their integrity and allowing for comprehensive audit trails. The historical data also serves as input for machine learning algorithms that improve anomaly detection and price prediction capabilities.

[87] Referring to FIG. 10, the token supply management process, detailed in steps 1010 through 1040, implements sophisticated monetary policy rules through smart contracts. These contracts encode complex policy frameworks that govern token issuance, redemption, and circulation. The rules engine supports both discretionary and algorithmic policy implementation, allowing for automated responses to changing market conditions while maintaining manual override capabilities for authorized personnel.

[88] Economic indicators are continuously monitored through a comprehensive data collection and analysis system. This system aggregates multiple economic metrics, including but not limited to inflation rates, exchange rates, trade balances, and economic growth indicators. Advanced analytics processes correlate these indicators with token supply metrics to inform policy decisions and trigger automated supply adjustments when predetermined conditions are met.

[89] The management system maintains strict minimum reserve ratios through a real-time monitoring and enforcement mechanism. This mechanism tracks the value of backing assets against outstanding tokens, implementing automatic safeguards to prevent reserve ratios from falling below required levels. The system includes predictive analytics capabilities that forecast potential reserve ratio changes based on market trends and planned token operations.

[90] Coordination with authorized financial institutions for distribution is managed through a secure communication and settlement network. This network implements standardized protocols for token distribution, ensuring proper documentation and tracking of all token movements. The coordination system includes sophisticated queuing and prioritization mechanisms to manage high-volume distribution operations while maintaining system stability.

[91] Referring to FIG. 11, the method implements comprehensive security and operational integrity measures through multiple sophisticated systems. At1110, multi-factor authentication for system access is implemented through a layered security architecture. This architecture combines multiple authentication factors including biometric verification, hardware security tokens, and knowledge-based challenges. The authentication system implements adaptive security measures that adjust requirements based on access patterns, risk levels, and operation types.

[92] At 1120, the system maintains comprehensive audit logs of all operations through a distributed logging infrastructure. This infrastructure implements secure, append-only logging mechanisms that record detailed information about every system operation, including timestamps, operator identities, operation parameters, and system responses. The logging system implements sophisticated data compression and indexing mechanisms to enable efficient storage and rapid retrieval of audit information while maintaining data integrity.

[93] Regular system security assessments are performed at 1130 through automated and manual evaluation processes. These assessments include comprehensive vulnerability scanning, penetration testing, and security control evaluation. The assessment framework implements continuous monitoring capabilities that provide real-time security posture information while scheduling periodic deep-dive evaluations of specific system components.

[94] At 1140, disaster recovery procedures are executed through a sophisticated business continuity framework. This framework implements automated failover capabilities, redundant system components, and geographically distributed backup facilities. The disaster recovery system maintains continuously updated recovery point objectives (RPOs) and recovery time objectives (RTOs) for all critical system components, implementing automated testing and validation of recovery capabilities.

[95] The system includes detailed playbooks for various disaster scenarios, ranging from minor component failures to catastrophic system events. These playbooks define specific response procedures, communication protocols, and recovery steps for each scenario type. The disaster recovery system implements regular drilling and testing procedures to ensure operational readiness and maintain staff familiarity with recovery protocols.